For a full transcript of this episode, click here.

CEOs and CFOs … hey, this show is for you. Let’s start here:

What do all of these numbers have in common: $140,000, $3 million, $35 million, and $3 billion?

These are all actual examples of how much employers, unions, and some public entities saved on healthcare benefits for themselves and their employees. The roadmap to saving 25% on pharmacy spend and/or 15% on total cost of care in ways that improve employee health and satisfaction always begins when one thing happens. There’s one vital first step.

That first step is CEOs and/or CFOs or their equivalents roll up their sleeves and get involved in healthcare benefits. Why can’t much happen without you, CEOs and CFOs?

Here’s the IRL: In 2023, the healthcare industry has been financialized. There is a whole financial layer in between your company and its healthcare benefits.

And unless the C-suite is involved here and bringing their financial acumen and organizational willpower to the equation, your company and your employees are currently paying hundreds of thousands, maybe millions, of dollars too much and doing so within a business model that deeply exacerbates inequities. There are people out there who are very strategically taking wild advantage of a situation where CEOs/CFOs fear anything to do with healthcare in the title and don’t do their normal level of due diligence. You think it’s an accident that this whole space got so “complicated”? HR needs your help.

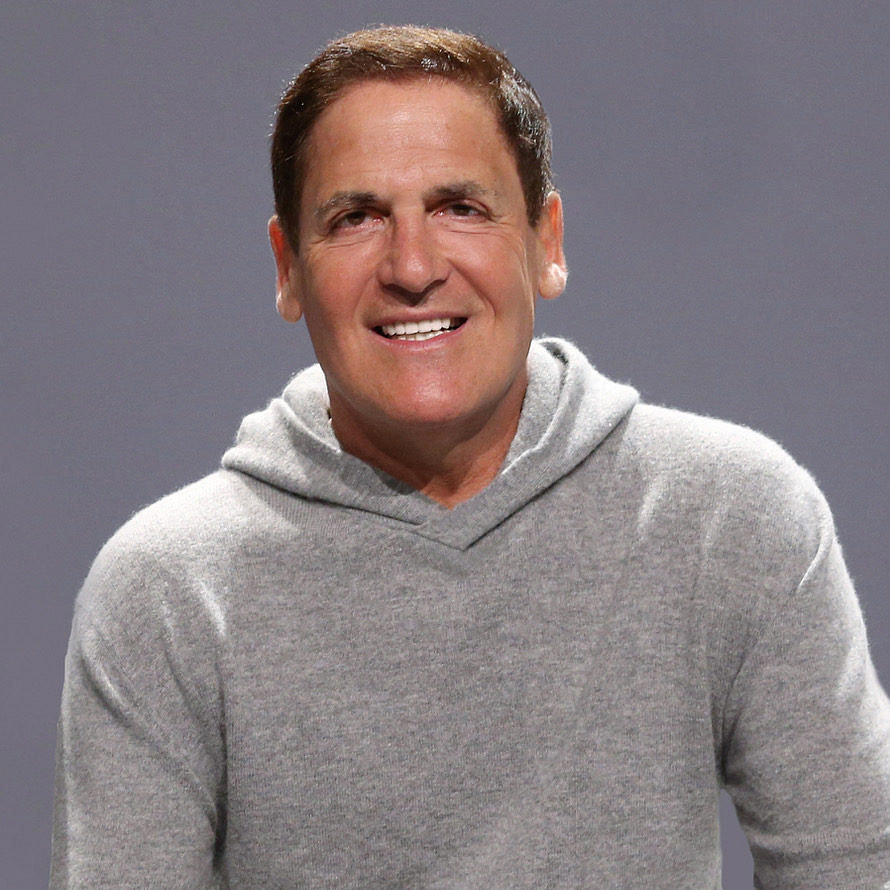

Bottom line, if you are a CEO or CFO and you do not know everything that Mark Cuban and Ferrin Williams talk about on the pod today … wow, are you getting shellacked. Mark Cuban uses a different word. Healthcare benefits are, after all, for most companies the second biggest line-item expense after payroll.

But don’t despair here, because all of this information is really and truly actionable. Others out there are cutting zeros off of their spend and actually doing it in ways that are a total win for employees as well.

My guest today, Mark Cuban, is a CEO, after all; and when he looked into it, it took him T-minus ten minutes to figure out just the order of magnitude that his “trusted” benefits consultants and PBM (pharmacy benefit manager) and ASOs (administrative services only) and others were extracting from his business. He pushed back. So can you.

But just another reason to dig into that financial layer wrapping around your employee health benefits right now, you might get sued by your employees. Below is an ad currently being sent around on LinkedIn by class action attorneys recruiting employee plan members to sue their employers for ERISA (Employee Retirement Income Security Act of 1974) violations. It’s the same attorneys, by the way, from those 401(k) class action lawsuits. I’ve talked to a few CEOs and CFOs who are scrambling to get ahead of that. You might want to consider doing so as well.

Now, for my HR professional listeners, considering that some of what Mark Cuban says in the pod that follows is indeed a little spicy, let me just recognize that the struggle is real.

There are multiple competing priorities out there in the real world, for sure. And bottom line, because of those multiple competing priorities out there in the real world, it’s really vital that everybody work together up and down the organization in alignment. Lauren Vela talks a lot about these realities here in episode 406.

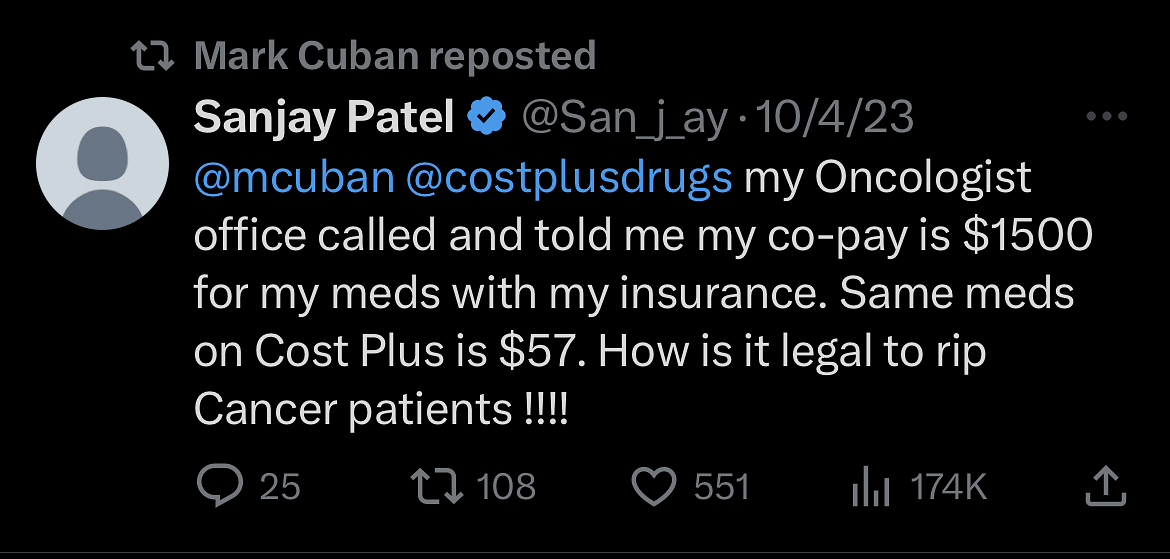

This is a longer show than normal, but it’s also like a show and a half. Mark Cuban talks not only about his work with Mark Cuban Cost Plus Drugs, which is a company that buys drugs direct from manufacturers and sells them for cost plus 15%, a dispensing fee, and shipping. It’s kind of crazy how so often that price is cheaper, sometimes considerably cheaper, than the price that plan members would have paid using their insurance—and the price that the plan is currently paying the PBM.

Most Relentless Health Value Tribe members (ie, regular listeners of this show) will already know all that, but what is also fascinating that Mark talks about is what he’s doing with his own businesses and the Mavericks on other fronts, like dealing with hospital prices. In this show, we also talk the language of indie pharmacies, fee-only benefits consultants, TPAs (third-party administrators), PBMs, and providers doing direct contracting. There are, in fact, entities out there trying to do the right thing; and Mark acknowledges that.

Ferrin Williams, PharmD, MBA, who is also my guest today, is chief pharmacy officer at Scripta and an expert in pharmacy benefits. She adds some great points and some context to this conversation. Scripta is partnering with Mark Cuban Cost Plus Drugs. Scripta has a neat Med Mapper tool and also services to help employees find the lowest costs for their prescriptions. If you are a self-insured employer, for sure, check out Scripta.

Here are links to other shows that you should listen to now if you are inspired to take action. I would recommend the shows with Paul Holmes (EP397); Dan Mendelson (Encore! EP385); Andreas Mang (upcoming); Rob Andrews (EP415); Cora Opsahl (EP372); Lauren Vela (EP406); Peter Hayes (EP346); Gloria Sachdev, PharmD, and Chris Skisak, PhD (EP390); and Mike Thompson (EP389). Also Mark Cuban mentions in this show the beverage distributor L&F Distributors.

Thanks to Ge Bai, Andreas Mang, Lauren Vela, Andrew Gordon, Andrew Williams, Cora Opsahl, Kevin Lyons, Pat Counihan, David Dierk, Connor Dierk, John Herrick, Helen Pfister, Kristin Begley, AJ Loiacono, and Joey Dizenhouse for your help preparing for this interview.

For a full transcript of this episode, click here.

You can learn more at Mark Cuban Cost Plus Drug Company and Scripta Insights.

You can also connect with Scripta and Ferrin on LinkedIn.

In 1995, Mark and longtime friend Todd Wagner came up with an internet-based solution to not being able to listen to Hoosiers basketball games out in Texas. That solution was Broadcast.com—streaming audio over the internet. In just four short years, Broadcast.com (then Audionet) would be sold to Yahoo!

Since his acquisition of the Dallas Mavericks in 2000, Mark has overseen the Mavs competing in the NBA Finals for the first time in franchise history in 2006—and becoming NBA World Champions in 2011.

Mark first appeared as a “Shark” on the ABC show Shark Tank in 2011, becoming the first ever to live Tweet a TV show. He has been a star on the hit show ever since and is an investor in an ever-growing portfolio of small businesses.

Mark is the best-selling author of How to Win at the Sport of Business. He holds multiple patents, including a virtual reality solution for vestibular-induced dizziness and a method for counting objects on the ground from a drone. He is the executive producer of movies that have been nominated for seven Academy Awards: Good Night and Good Luck and Enron: The Smartest Guys in the Room.

Mark established Sharesleuth, a research and investigation Web site to uncover fraud in financial markets, and endowed the Electronic Frontier Foundation’s Mark Cuban Chair to Eliminate Stupid Patents, an effort to fight patent trolls.

Mark gives back to the communities that promoted his success through the Mark Cuban Foundation. The Foundation’s AI Bootcamps Initiative hosts free Introduction to AI Bootcamps for low-income high schoolers, starting in Dallas. Mark also saved and annually funds the Dallas Saint Patrick’s Day Parade, the largest parade in Dallas and a city institution.

In January 2022, he started Mark Cuban Cost Plus Drug Company as an effort to disrupt the drug industry and to help end ridiculous drug prices because every American should have access to safe, affordable medicines.

As chief pharmacy officer, Ferrin leads the company’s clinical strategies organization responsible for devising innovative cost-containment strategies for prescription drugs, ensuring Scripta clients, members, and their providers are provided with best-in-class clinical insights and tools.

Ferrin earned her bachelor’s, Doctor of Pharmacy, and MBA degrees from the University of Oklahoma.

05:41 What was Mark Cuban’s own journey as a self-insured employer with Cost Plus Drug Company?

06:56 What did Mark find when he decided to go through and look through his company’s benefit program?

08:23 “When you think it through, you start to realize that money is being spent primarily by your sickest employees.” —Mark

09:13 How do you get CEOs and CFOs of self-insured employers to realize that their sickest employees are the ones subsidizing their checks?

12:10 What is the role of insurance in healthcare?

13:42 “If you can’t convince them, confuse them and hide it.” —Mark

14:35 The reality behind getting a rebate check.

15:32 Why are rebates going away, and why isn’t that changing PBM earnings?

18:17 How do you get CEOs and CFOs to dig into their benefits plan?

20:13 Does morally abhorrent move the needle?

20:47 “What we’re trying to do is just simplify the [healthcare] industry.” —Mark

23:33 What’s been changing in consumer behavior?

24:18 “Transparency is a huge part of building that trust.” —Ferrin

24:33 Why CEOs and CFOs really have the power to change healthcare.

31:42 What are Cost Plus Drugs’ plans to expand?

38:36 Where is the future of the prescription drug market going?

41:25 What will happen to the prescription drug market in 10 to 20 years?

47:56 The wake-up call self-insured employers should be acknowledging now.

51:18 Where is the real change in the healthcare industry going to come from?

You can learn more at Mark Cuban Cost Plus Drug Company and Scripta Insights.

You can also connect with Scripta and Ferrin on LinkedIn.

Recent past interviews:

Click a guest’s name for their latest RHV episode!

Dan Mendelson (Encore! EP385), Josh Berlin, Dr Adam Brown, Rob Andrews, Justina Lehman, Dr Will Shrank, Dr Carly Eckert (Encore! EP361), Dr Robert Pearl, Larry Bauer (Summer Shorts 8), Secretary Dr David Shulkin and Erin Mistry